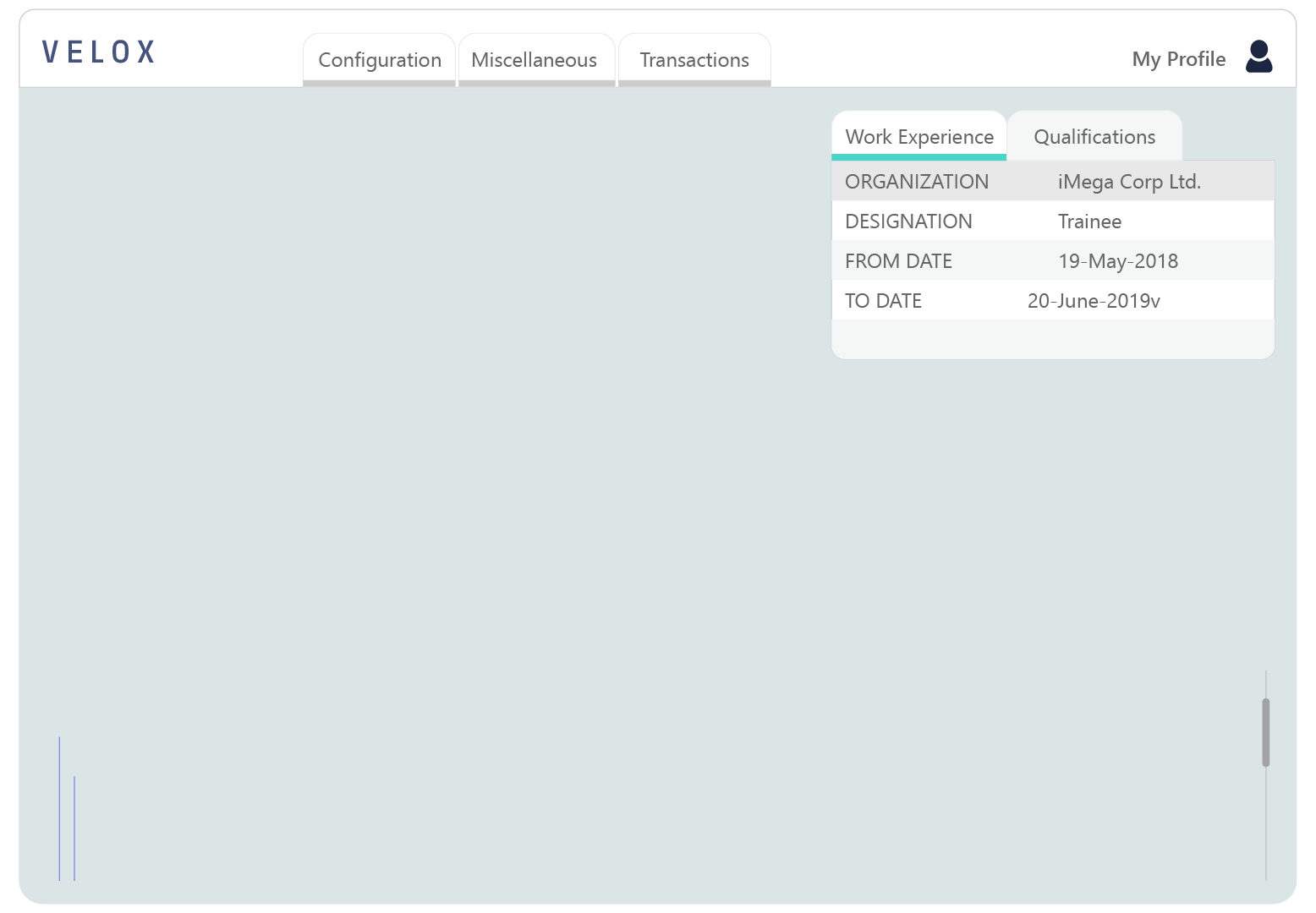

Velox PIT

SEBI PIT Regulations Software

Velox is a mobile & web-enabled multi-scrip and multi-asset class solution for end to end tracking and managing employees’ investments and holdings, to ensure compliance as per SEBI‘s Prohibition of Insider Trading Regulations & UPSI.

Book a Demo

TRUSTED by 30+ Institutions with over 15K users including 9 large mutual funds, 3 life insurance companies, 11 broking houses, 3 merchant banks and 2 investment banking companies and 1 rating agency.

Enables automated seamless system integrations across varied platforms, networks, systems, APIs etc.

.svg)

Extracts & transforms data from complex data sources.

Performs automated reconciliations, bank transfers & cash flow activities

.svg)

.svg)